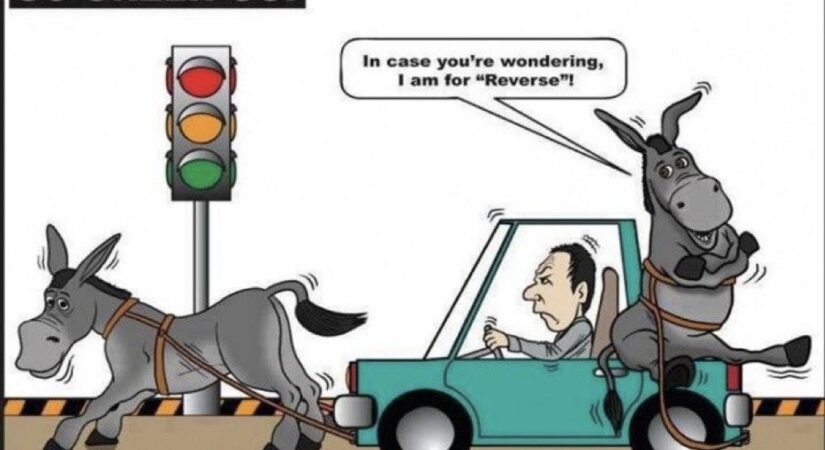

It has been proud era for donkeys recently when Pakistan turned to them to boost its revenue and friendship with China. And if what is shown in the featured image above comes true when the EV market is still at a nascent stage, then donkey rich countries may become billionaires overnight.

In India, taxes make upto 54 per cent of the price of petrol and over 48 per cent of diesel. In the fight between the States and the Central government in revenue share from it, it is unfortunate that petrol and diesel are still out of GST. This leads to cascading effect on the retail price in the hands of the final consumer every time the deregulated Oil price increases in the global markets. In the initial stages of Covid 19, when the entire world was at standstill, Oil was quoting at a low of USD 19 a barrel. With economy stagnant and government coffers drying up with issues such as increased expenditure to fund various initiatives, increase in tax rates of Oil was the fastest solution to balance the shortfall. However since this low, currently Oil is trading around USD 85 per barrel. With this background, the prices of petrol and diesel have crossed their historic highs recently causing unease with citizens and businesspersons all alike.

Amid a clamour by the Opposition for cutting taxes to soften record high petrol and diesel prices, Oil Minister Hardeep Singh Puri equated the move to ‘axing one’s own feet’, saying such levies funded government schemes to provide free COVID-19 vaccines, meals and cooking gas to millions amid the pandemic.

Minister of State for Petroleum and Natural Gas Rameswar Teli in July, 2021 told Parliament that the Union government’s tax collections on petrol and diesel jumped by 88 per cent to Rs 3.35 lakh crore in the year to March 31 from Rs 1.78 lakh crore a year back. Excise collection in pre-pandemic 2018-19 stood at Rs 2.13 lakh crore.

NPowersU Expert Opinion

Since the State governments and the Central government have their share in the taxes collected from sale of Oil, it is like who will blink first to cut the rates of taxes on oil. Recently, with certain state elections in mind, Central government has reduced excise on petrol and diesel by INR 5/- and INR 10/- per litre respectively. Some states have followed suit and reduced VAT on these products. However many other states are yet to follow suit. However more needs to be done by all the governments concerned. Whatever be the reasons, it is the final consumer who is the ultimate sufferer in the form of increase in inflation in near future.

Sometimes the simplest solution at one stage is not the best solution when the economy is in the recovery stage. Let us say sayonara with a funny idiom

“OIL not the goose that lays the golden egg”

Related Link