Economic Survey is an important part for deciding future course of action by the Finance Ministry through its annual budget for the country. With this brief let’s have a brief roundup of the latest survey done at our cost

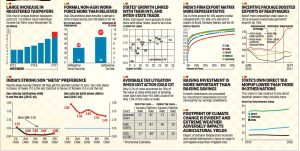

- Increase in registered Direct and Indirect tax payers –

o In volume terms – 1.80 Million new individual Income-tax payers and

o 50% rise in Indirect tax payers as compared to previous years.

Mainly due to demonetisation and implementation of country-wide GST.

- Formal non-agricultural payroll is much greater than believed – Employee based in non-agricultural sector are more than what was believed. This exercise compared number of registered employees under social security registrations (PF and ESIC) and GST registrations rather than the earlier base of only Income-tax assessees.

- States’ prosperity is correlated with their international and inter-state trade – Self-sufficient states are averse to prosperity as compared to than open states.

- India’s firm export structure is substantially more egalitarian than in other large countries – India’s share in exports are contributed by much larger base as compared to other large countries like Brazil, Germany, Mexico, and USA.

- The clothing incentive package boosted exports of readymade garments as compared to incentive packages to other industries

- Indian society exhibits strong son “Meta” Preference – Preference over male child as compared to girl child

- There is substantial avoidable litigation in the tax arena which government action could reduce – Even a beggar in India knows this. Our government required economic survey to point this anomaly to them. Great India!

- To re-ignite growth, raising investment is more important than raising saving – One ill effect of this pointer is seen in the proposed budget that throws light on the misses in current year’s budget

- Own direct tax collections by Indian states and local governments are significantly lower than those of their counterparts in other federal countries – This scenario will remain unchanged in future till one important part is taxed in India for the benefit of the countrymen discussed in the expert opinion following this blog.

- The footprint of climate change is evident and extreme weather adversely impacts agricultural yields – With recent winter temperatures showing high intra-day volatility this news is not a surprise to anyone.

With all the above news, the economic survey predicts GDP to accelerate from 6.75% this year to 7-7.5% in 2019.

Bird’s eye view of economic survey in graph

NPowersU Expert Opinion

Survey without any line of action is fruitless. Some actions by the government are taken blindly without realising economic impact and global image that there we are short of words. And some hard actions are postponed even though they are the clear answers to all the problems.

Example of action taken blindly to re-ignite growth, raising investment is more important than raising saving –

Tax on Long Term Capital Gains on listed equity shares and equity oriented mutual funds proposed at 10% in the recent budget effective from 1st April, 2018 with some carrots

Example of action avoided – Direct tax collections are lower in India as compared to other federal countries –

Taxing agriculture income of High Net Worth individuals

Related Links

Article link

Economic Survey PDF file link

http://mofapp.nic.in:8080/economicsurvey/pdf/000_Preface_Ten_Facts_2017-18_Vol_1-18_pages.pdf