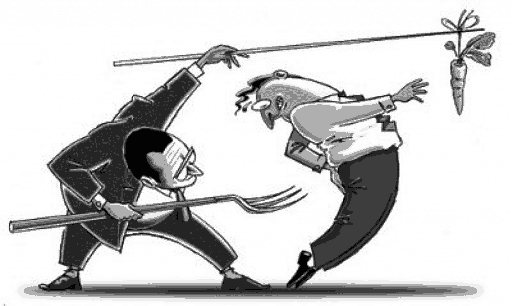

Government has something new up its sleeve every time in its annual budget. Generally on the Budget day, Finance ministers’ speech has goodies making the listeners happy and gay. However when the provisions are read in detail, tax payers feel the heat whether they were better off without the carrot and should fear the fork. This is elegantly portrayed in the picture above.

Due to lack of clarity in certain direct taxes provision, in this blog we will discuss applicability of Equalisation levy and withholding tax on payments towards digital transactions.

The Equalisation Levy introduced by the Finance Act 2016, was charged at 6% on certain online advertising and related services. The Finance Act 2020 amended the Finance Act 2016, introducing a new Equalisation Levy at 2% on the consideration received/receivable by an e-commerce operator from the transactions related to e-commerce supply or services. One major difference between old and new Equalisation levy is liability to recover and pay in the former version was on the payer while in the later version it is on the payee.

As per Income-tax provisions read together with High Power Committee report on taxation of e-commerce transaction (2002), payment towards certain software services are taxable as royalties. Withholding tax rate thereof is dependent on Double Tax Avoidance Agreement (DTA) between India and other Country or tax rate as per local provisions, whichever is beneficial to the assessee. Such tax rate ranges between 10-40% plus applicable surcharge and education cess. Though Supreme Court of India in case of Engineering Analysis in March, 2021 has decided that payment towards imported computer software is not royalty, there is some doubt if it can be equally applied to the new era SaaS-based payments.

In view of the above, payees will prefer paying Equalisation levy at the rate of 2% and recovering the same from the payers whereas payers will prefer following Income-tax provision in order to keep the local taxman happy. Some companies are being cautious and paying both taxes on each transactions- royalty withholding tax plus the equalization levy.

Due to this anomaly, a US-based tech company, Sumo Logic has moved the Delhi High Court in August, 2021 challenging the applicability of income-tax at 10 per cent rate against an equalisation levy (EL) of 2 per cent. The court has issued notice to the Centre.

NPowersU Expert Opinion

To add to the cost burden, NPowersU team has come across a foreign e-commerce operator, having an Indian office, providing outsourcing services whereby Indian users have an option to select software services provided by suppliers around the globe. To be triply sure and be on good side of Indian law, this e-commerce operator levies equalisation levy at 2%, GST at the rate of 18% and recovers withholding tax liability from the Indian service user on every transaction. Government is happy earning tax revenue without realising if global competitiveness, which is price sensitive, is compromised there will be lower income for the assessees thereby resulting in lower tax revenue.

Let us end today’s blog with an advice to the government. Rather than the rhetoric of “Ease of doing Business” to global investors, it should concentrate on “Ease of complying with taxation laws” resulting in win-win situation to everyone.

Related Link

https://theoutreach.in/us-firm-moves-delhi-hc-on-equalisation-levy-royalty/