Two opposite statements in the header will guide us through this blog. Be it roads or tax, one way traffic always causes accidents. However unlike roads where there are only minor accidents, in Income-tax the accidents are always major and mostly one sided. Professionals practicing Income-tax will agree to the below mentioned statements:

- ‘Please pay the tax demand/ advance tax, as we need to meet ‘Our targets’ set by Central Board of Direct taxes.’

- ‘We can’t help even though it is a decided case. Additions will be made as we have orders from above. You can always win at the tribunal level.’

- ‘This is a high profile case and we do not want to take the risk. Please bear with us.’

These statements looks like a ‘hafta vasooli’ statements but these are facts. It is interesting to note that Income-tax department has a Citizen’s charter issued way back in 2014 setting timelines for various key services and confirming its commitment to the Tax payers of the Country. Whether the above charter is being implemented is anybody’s guess.

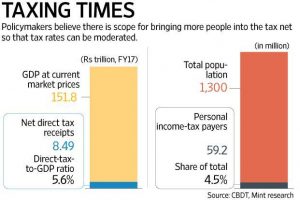

It was music to our ears when the government recently announced setting up task force to draft a new direct taxes code in the light of global best practices and the economic needs of the country. As understood the government is interested in increasing the tax base and lower tax rates since India’s current direct tax-to-GDP ratio is 5.60% as per the below graphic presentation:

NPowersU Expert Opinion

The Comptroller and Audit General of India (CAG) has rapped CBDT for making “exaggerated” tax demands on large corporate firms which were refunded in the next financial year in its report placed before the Parliament on 19th December, 2017. We trust that the tax department will mend its ways in future.

The tax department could follow its Citizen Charter issued in the year 2014 in SPIRIT than spirit prices would have come down by now as consumption thereof by citizens would have fallen to a great extent! But reduction in consumption means reduction in tax revenue generated from one of the largest source – Liquor. This will lead to high pitched assessments from the Indirect taxes? (We are ending it on a lighter note)

Related Link: