With everything including love available on loan in this materialistic world it is no wonder that the Global debt is rising leaps and bounds year after year. As per report by the Institute of International Finance (IIF) for the third quarter ended 31st December, 2017, Global debt hit an all-time high of $233 trillion (£169 trillion). This is an increase of over $ 16 trillion over the debt at the end of 2016. This is three times the size of the current Global economy.

Readers will be intrigued to know the answers to the following questions:

- a) Who has all this debt?

- b) Who is it owed to?

- c) What does this level of indebtedness mean?

- d) And how worried should we be about it?

Answers

a) Who has all this debt?

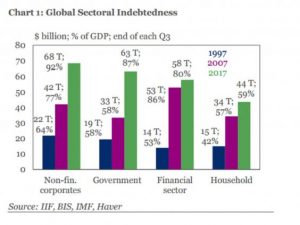

Answers are depicted in the chart below

b) Who is it owed to?

The money is owed to ‘US’. Because every liability, unlike the 2008 Global meltdown, is supported by an equivalent or more asset. That is to say that asset is financed by debt.

c) What does this level of indebtedness mean?

Upto a point there is no worry. But why does a person need finance? Reason – His current income or savings is not enough to buy the loaned asset. Asset can be anything from expanding existing business capacity or build an educational institution or finance a movable asset or immovable asset.

The situation becomes critical only when the interest or the loan amount cannot be repaid due to various reasons. This is the most scary situation for the lenders and financers being banks and/ financial institutions.

In the above situation if the borrower is a Government of a country then effects there can be huge. History has proved that under borrowing or over borrowing can have catastrophic effects. Greece is a classic example of under borrowing and Pakistan can be considered a classic example of over borrowing.

d) And how worried should we be about it?

Some argue that giant global banks fund debts rather than equity which may cause 2008 like situations. Similarly hike in interest rate may prove a disaster as it will lead to repayment defaults.

On a positive note though IIF feels that rising incomes and rising GDP has kept tab on the rising debt such that share of global debt to global GDP has been falling for four consecutive quarters and rising income will make servicing borrowings easier.

On a closing note world economists are worried about the Chinese economy (second largest in the world) as corporate borrowings has exploded which may destabilize the economy if not kept in check. Similar worries are felt in UK too.

Most economists feel that equity funding should take prominence over debt funding. But the scenario will remain unchanged till interest servicing is kept tax deductible.

NPowersU Expert Opinion

World over it is seen that for business expansion the easiest and tax efficient way is to borrow funds rather than equity funding. This sometimes leads to over expansion as can be seen in Chinese economy which has grown too huge in size that the only way for the economy to survive is to dump goods abroad. Any negative impact in global economy has far reaching consequences on its internal economy.

Secondly ease of finance leads to corporates and non-corporates spend on non-essential things. All these borrowings become a curse when tides turn. End result is bankruptcy of the borrower and later on the lender too.

India has witnessed sizeable NPA’s in the recent past. Many prominent business owners are on the verge of being declared bankrupt. Lesson to be learnt is that lenders should also do their maths right. In the competition to better their competitors need of the hour suggests to get the facts right and strictly follow laid down procedures and guidelines.

In the interest of the Global economy industry specific debt equity ratios should be derived. Any excess should necessary be funded as equity. This will lead to debt equity balance and a win-win situation for all.

True jovial story – “All borrowers are not as lucky as Anil who on the verge of being declared bankrupt was pulled out in time by his brother, Mukesh. Just in case of ‘communication’, relationship between ‘Reliance to Reliance is free’.”

Related Link