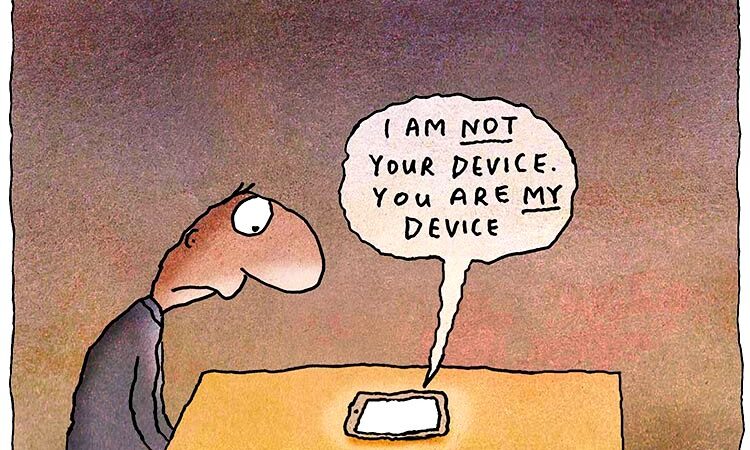

The feature image subtly conveys the current gadget culture prevalent all throughout the world. However benefits of gadget go beyond the image only if device does not control you. In this blog let’s list one benefit of using a digital device; namely digital banking.

Gone are the days when one had to stand in a queue to withdraw money from their bank account. Now, everything happens at the click of a button, whether it is paying your cab driver, shopping online, investing in mutual funds or transferring rent to your landlord; it all happens seamlessly in seconds with digital banks. A digital bank can be opened with just a video KYC call from the bank and also ensures a seamless, paperless and transparent process.

Unlike physical

banking, digital banking has the following advantages:

- 24×7 access,

- instant money transfers,

- quick bill payments,

- smart investments,

- buying insurance,

- Cash back from banks for using digital bank, (As applicable)

- Security features provided by the bank to safeguard against fraud.

The above are a few advantages of digital banking.

According to Research & Markets.com, the Indian digital payments industry is expected to touch $700 billion by 2022 in terms of value of transactions. Nearly 80% of urban India is expected to adopt digital payments as a part of their routine. The reduced transaction charges and ease of cash transfers associated with electronic fund transfers and mobile banking will further drive the growth of digital payments in India, stated the report. Before Covid-19 the industry was growing at a 16% YOY increase, but the pace was expedited to over 22% after the pandemic.

NPowersU Expert Opinion

As per recent media reports, around the world digital frauds are increasing at phenomenal pace as compared to physical thefts. Hackers come out with innovative ways to defraud the citizens. No matter how many security features are inbuilt in the bank provided apps to carry out digital transactions, the ultimate responsibility of following safeguards announced by the Apex bank and individual bank from time to time lies with the user.

Or else sooner or later, ‘digital banking to bank-rupt’ is also ‘a click away.’

Related Link