Human greed is insatiable. We have virtual currency, stock and securities, fixed deposits, mutual funds, immovable properties and such modes for investments. But our ever indulgent nature of getting us higher into the materialistic world has led to speculating in ‘Cryptocurrency’. It is said that cryptocurrency was born after failure of financial institutions like Lehman brothers in 2008. Bitcoin is one such cryptocurrency. Ethereum, Litecoin, Dash and Ripple are quite popular among cryptocurrency users.

Bitcoin is the first decentralized digital currency – the system works without a central repository or single administrator. The network is peer-to-peer and transactions take place between users directly through the use of cryptography, without an intermediary. These transactions are verified by network nodes and recorded in a public distributed ledger called a blockchain.

Just as all developed countries, the Apex bank of India is taking time for issuing guidelines for cryptocurrencies. On 5th December, 2017 the Reserve Bank of India has even cautioned bitcoin and other cryptocurrency enthusiasts that they face potential risks, including financial, legal and those related to customer protection. But Bitcoin has not paid heed to these warnings – It reached a high of USD 19,500 on 7th December, 2017 on US based GDAX before tumbling to USD 13,482 on 8th December at around 12GMT. Nevertheless the lust of cryptocurrencies has conquered hearts of Indians equally as people around the world. Boon of Cryptocurrencies is that they can be bought and sold in fractions. There are about eleven trading platforms in India to buy Bitcoins. Those include Unocoin, Zebpay, Coinsecure, Coinmama, LocalBitcoins, Bitcoin ATMs. Bitcoins can be bought and sold by downloading a software available on website www.bitcoin.org A trial version of the software is also available which helps one to get accustomed to buying and selling bitcoins without investing money. INR 100 invested in Bitcoin in the year 2010 is worth approximately INR 3.20 Crores as of now.

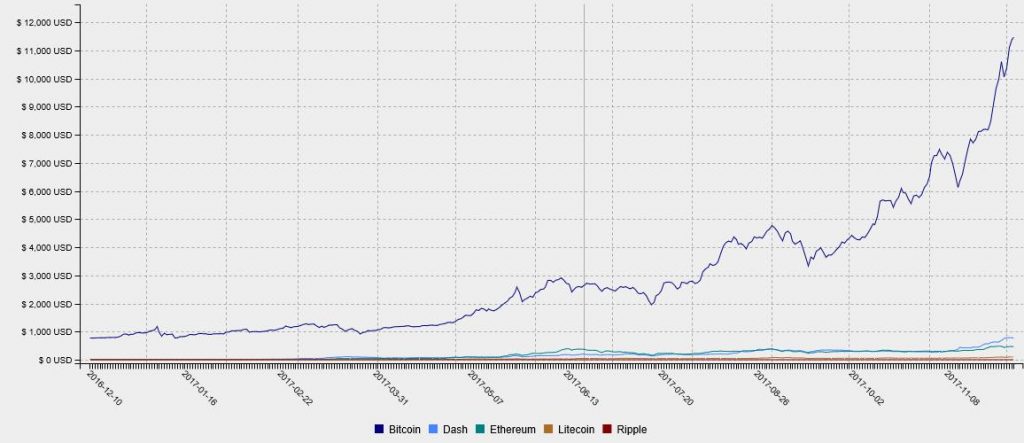

Below chart is a bird’s eye view of performance of various cryptocurrencies over one year period: (October, 2016 to November, 2017)

NPowersU Expert Opinion

Is this a bubble that will burst? Experts like Warren Buffet, legendary investor and Jamie Dimon, CEO JP Morgan Chase, are waiting for that to happen since its inception as it is not backed by underlying monetary base. And now when the returns have crossed astronomical figures within a limited time they have more reasons to believe the same. As is prevalent in stock market – ‘Whether one can time the market?’. One cannot time cryptocurencies as well. This ‘corrupt’ coin is a blessing in disguise for hackers who deployed the WannaCry virus and collected ransom in bitcoins from their victims to unlock computers.

Our team has one important point to share with the readers. What happens if hackers loot Bitcoins owned by a person and sell it? The gullible person cannot do anything. Bitcoin itself does not have any mechanism to restore the stolen coins and since they are not backed by the Apex bank, he cannot fall back on anyone. ‘Rags to Riches’ and ‘Riches to Ashes’ in minutes. One person can take a back-up of coins but like a computer files these coins can be copied and sold to third party very easily. Next best Cryptocurrency ‘Ether’ has safety precautions where in case of stolen coins the agency will restore the coins back to the owner. As a short term investment, cryptocurrencies can be given a try. What is short term, is individual preference and risk bearing appetite.

Sound advice – “Happy Gambling with heavy rumbling in your pockets.’

Related Links:

Article: