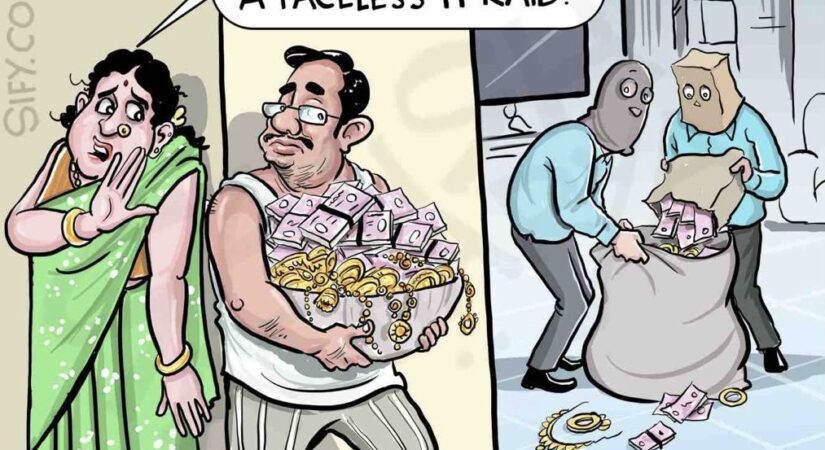

The transition from VAT regime to GST regime in India was never going to be easy. This view was expressed by experts in this field. Expectations were high from the Government for simplification. To eradicate corruption in direct and indirect taxation government has recently introduced faceless tax assessments. Moving forward the scheme is being considered for various courts as well. This is jovially depicted in the image of this article.

Introduction of faceless assessments is not worrying the taxpayers. The real worries extend to tax portal issues, uncertainty on tax rates on items in GST, different views and judgements on same issues by courts situated in different states and the list is endless.

Two odd years ago, actor Rahul Bose broke the internet when he tweeted that he was charged a steep INR 442.50 (including goods & services tax, or GST) for two bananas at a well-known five-star hotel in Chandigarh. This had led to inquiries by the GST authorities and ultimately a fine was imposed on the hotel as fruits do not attract GST.

But, and there is a big but involved, if fruits have been sliced and diced and

served to customers in sealed bowls, they will attract GST at 5%.

The Karnataka Authority for Advance Rulings (AAR), which passed this ruling, did not deal with an instance of fruits served in a hotel, but fruits supplied by Juzi Fruits, a private company in Bengaluru. This company is engaged in the purchase and subsequent supply of fresh fruits in bowls (with or without the addition of dry fruits & nuts). While edible fruits and nuts do not attract GST, the AAR bench held that these bowls of fruit, which are sold under a brand name, would attract GST at the rate of 5% under Entry Number 59 of Schedule 1. If the fresh fruits were sold with dry fruits & nuts, then it would be a mixed supply and attract GST at the higher rate applicable to either the fruits or the dry fruits & nuts.

In line with the above AAR, earlier too similar judgements were passed by courts one such being wherein branded frozen seafood sold attracts GST and unbranded ones does not attract GST. However the above was not the case in earlier VAT regime causing heartburn to the business community.

NPowersU Expert Opinion

E-tailors like Amazon, Jiomart and others sell unbranded fruits and vegetables and escape from the GST liability. However, when the package is received by their clients it is always packed in their respective packaging. Whether this is sale of branded goods? Hope the tax personnel do not read this article.

It is well known that Indian businesspersons are always one up the taxpersons. Let’s end this blog with a ‘nutty’ question for the crazy ‘GST’ in relation to the case law discussed above:

‘When dry fruits & nuts are sold with sliced fruits in a single bowl it attracts higher GST rate on the entire goods. What if a smart businessperson sells dry fruits & nuts in a separate sachet with printed price and sells alongwith the sliced bowl of fruits?’

Related Link