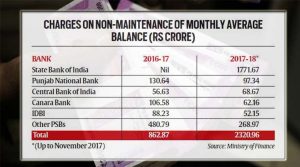

Buoyed by NPA’s, public sector banks seems to have found new love from its existing customers to charge for various services including charges for non-maintenance of minimum account balance (MAB) with them. Further it is intriguing to note that the largest bank of the country, State Bank of India, has earned Rs. 1771 crores through only one component of bank charges (MAB) which is more than the bank’s July-September 2017 quarter net profit of Rs 1,581.55 crores and nearly half of the Rs 3,586 crores it earned as net profit April-September, 2017.

As per data available from the Ministry of Finance comparative figures of one element of bank charges earned by various Public Sector banks being non-maintenance of MAB are as under

With this brief let us compare various charges levied by banks (Public and Private) for information of readers

NPowersU Team Expert Opinion

There are no free lunches in these trying times. Any Time Money (ATM) charge is a classic example. ATM has reduced banks reliance of its own staff to disburse funds and thus saving overall costs as compared to maintaining an ATM. Reduced footfalls in banks have led to availability of staff for other productive and remunerative work and effective use of scarce office space. If the Apex bank had not intervened, ATM charges would have been levied on all withdrawals leading to curse for all and sundry.

The point that we want to convey through this blog is that finance management is not restricted to earning more income but also keeping tab on these small but cumulative large outgo that one generally fails to keep track.

We end this blog with this funny caption “Penny ‘wise’ will never lead to Pound ‘foolish’.”

Related Links