The Great Indian tax department is at it again. To achieve targets set by CBDT, it has once again raised a high pitched demand against Flipkart India Pvt. Ltd. And this time it has the stamp of approval by the Income-tax Appellant Tribunal, Bengaluru. The tax department must surely be thinking how can a loss making company attract a valuation of USD 9.36 Billion as per Morgan Stanley for the quarter ended 30th September, 2017. So let us party as well.

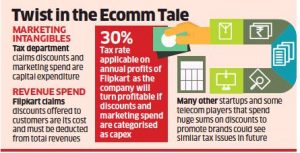

The issue involves money spent by ecommerce companies on marketing through deep discounts. These ecommerce companies have been classifying this as marketing expenses leading them to post losses. As per the tax department these expenses cannot be treated as revenue expenditure but capital expenditure (marketing intangibles) to be amortized over a period between 4 to 10 years. This treatment will change their loss as per financial statements into profits as per the Income-tax Act leading to Income-tax liability thereon.

This is conveniently illustrated in the chart below

The matter will be surely be litigated by Flipkart at higher level. But the ball has started rolling and other industry specific companies illustrated above can expect similar demands in the near future.

For instance, a company has incurred Rs. 50 crores in marketing costs. If classified as revenue expenditure, this will be deducted in one financial year. If it is classified as capital expenditure then amortisation of 10% applied over 10 years will result in only Rs. 5 crores being deducted in a financial year. In the second scenario, the company will end up making a profit and have to pay tax @ of 30% (plus applicable surcharge and education cess) annually.

NPowersU Expert Opinion

As deliberated in various forums, ‘Ease of doing business’ cannot be a statement but must be backed by sincere implementation. Laws, be it Income-tax or others, having different meanings to different persons will always lead to such absurd results. The matter will go on till Supreme Court leading to wastage of resources for all concerned.

Related Link