After plunging into celebrations and joys of welcoming the New Year, let’s have a quick recap on important provisions and summary of avoidable cash transactions and penal consequences under the Income-tax Act, 1961 applicable for Financial Year 2017-18 thereof

| S. no. | Section | Cap on cash transaction | Penalty for cash transaction |

| 1. | 13A -Exemption to political parties | Receipt of cash donation above Rs 2,000 | No exemption |

| 2. | 40A(3)- Disallowance for cash expenditure | Payment of any expenditure above Rs. 10,000 | No deduction |

| Payments for plying, hiring or leasing of goods carriage above Rs 35,000 | |||

| 3. | 43(1)- Determination of actual cost of asset | Payment above 10,000 for purchase of asset | Such payment won’t be included in actual cost of asset (viz, No depreciation) |

| 4. | 35AD- Investment linked deduction for capital expenditure | Payment above Rs 10,000 for any capital expenditure | No deduction |

| 5. | 80D- Health Insurance premium | No cash payment allowed | No deduction |

| 6. | 80G – Donations to certain funds and charitable institutions | Donations above Rs. 2,000 | No deduction |

| 4. | 80GGA- Donations for scientific research or rural development. | Cash donation above Rs. 10,000 | No deduction |

| 5. | 80GGB – Donations by companies to political parties. | No cash payment allowed | No deduction |

| 6. | 80GGC – Donations by any person to political parties | No cash payment allowed | No deduction |

| 7. | 269SS- Prohibition on acceptance of cash loans, deposits, etc. | Rs. 20,000 or more | 100% of amount received |

| 8. | 269ST- Prohibition on receiving cash | Rs. 2,00,000 or more | 100% of amount received |

| 9. | 269T – Prohibition on repayment of loans or deposits in cash | Rs. 20,000 or more | 100% of amount paid |

Now Mr. Can-fused unaware of the above provisions which change from year to year within the change in seasons has sold all his goods individually valued Rs. 2 Lakhs each in cash and is very happy making a neat 100% profit. He was really happy when the customers were lapping up his products lock stock and barrel by paying cash. Never in his life had he achieved such a huge turnover. In New Year he was planning to buy his wife a gold studded diamond necklace. He paid a visit to his tax consultant for his advance tax payment and hell broke loose after he was advised that 100% of amount received needs to be paid towards penalty leading him to pay tax out of his own pockets.

Dejected he meets his friend who advises him to change the address as per Income-tax records and you will live in peace. You will not receive notice and you are King once again.

But unfortunately tax department are one up and have amended rules so that citizens cannot fudge with the addresses. As per the amendment to the Income-tax Rules effective from 20th December, 2017, the Income-tax notice, in case it is not deliverable/ transmittable to available address, the department may use addresses as per other databases available

- Address given to the bank;

- Address given to the insurance company;

- Address given to the post office while investing in the Post Office schemes;

- Address as available in government records;

- Address available in the records of local authorities;

- Address of the assessee as furnished in Form 61 to the income tax department under Rule 114D;

- Address as furnished in Form 61A to the tax department under rule 114E.

NPowersU Expert Opinion

Moral of the story is citizens need to buck up and do timely and correct compliance of the law in case to safeguard their interest. This is the only way one can buy peace in future. With aadhaar linking, it will be next to impossible to avoid law catching up. ‘Better be safe than sorry’, is the mantra of this Government.

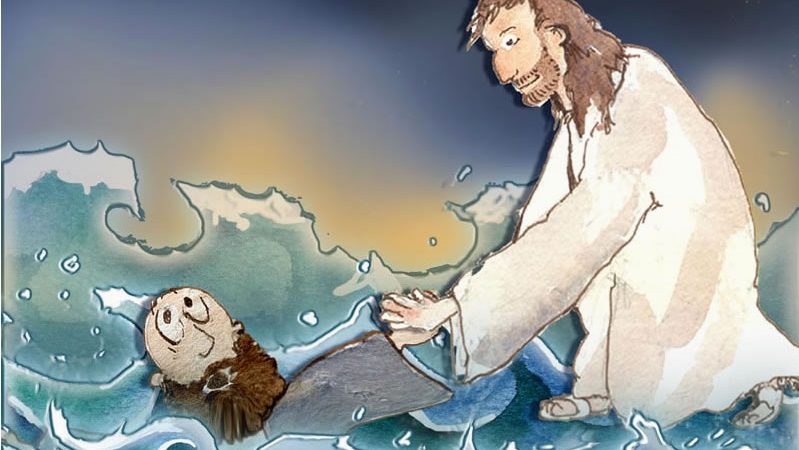

So the image of the blogs truly stands out and complements the title – Only God can save you ONLY when you are in HIS arms.”

Related Link:

Article Link

Income-tax Notification link